Markets have some good data to price in off the printers this morning. Core PCE Price Index month-over-month (MoM), which excludes volatile food and energy prices, came in lower than expected at 0.3% versus 0.4% expected.

PCE Price Index month-over-month (MoM), including food and energy, came in lower as well at 0.3% versus 0.5% expected.

What does this mean? Well it means the Fed’s interest rate hikes are working – sort of. Inflation is still sticky and the Fed’s inflation war has taken a back seat to bank’s failing to manage balance sheet risk properly. The S&P 500 is set for a winning week and up on Friday.

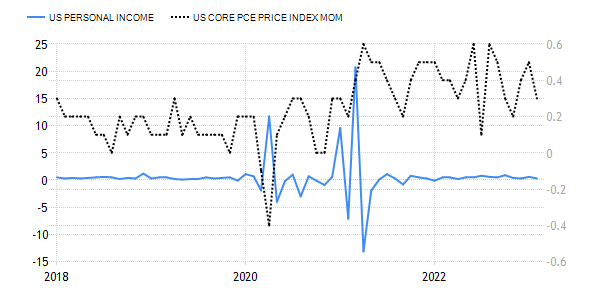

Here is some more bad news on the Fed’s inflation war. US Personal Income has been below Core PCE since 2022. This means Americans are making less while prices are increasing.