The talk of the rally has been about rate cuts. That is for good reason. The cost of borrowing is extremely influential on financial asset prices. The current Fed Funds rate is in the 5.25% – 5.50% range.

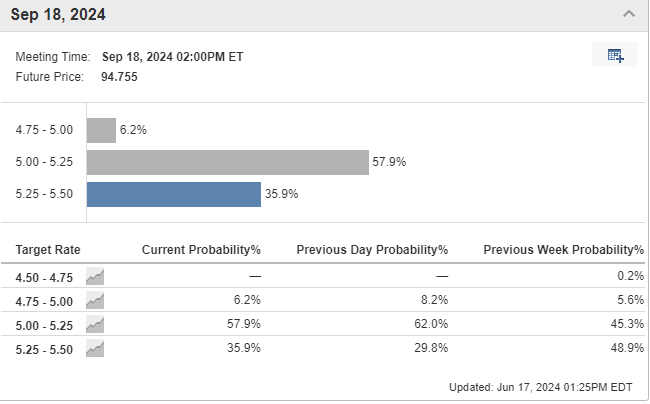

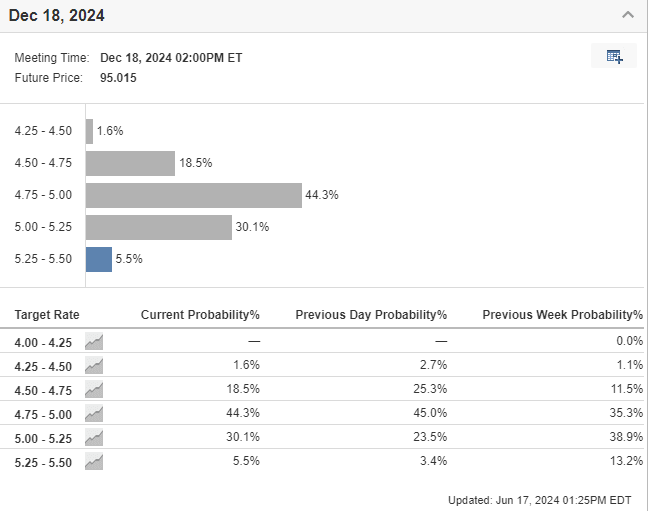

Currently, markets have two rate cuts priced in for 2024. One in September 2024 and one in December 2024.

If inflation keeps moving in the right direction, two cuts seems reasonable at this point.

Markets are saying two cuts while Fed Officials are saying one cut this year. Personally, I would not be shocked if there were zero cuts this year. The only way I see there being being cut in September is if inflation data comes in below or at expectation over the summer months.

Stay tuned and let’s see what happens!

Leave a comment