Markets are always worried about something.

Covid, China, failing banks, Ukraine, government shutdown, etc.

Markets will always find something to worry about. Today it happens to be rates. Rate have been the talk of the town and for good reason.

Nobody knows where they are headed. I don’ think the Fed even knows where rates are going. I don’t blame them though, how could you in this environment?

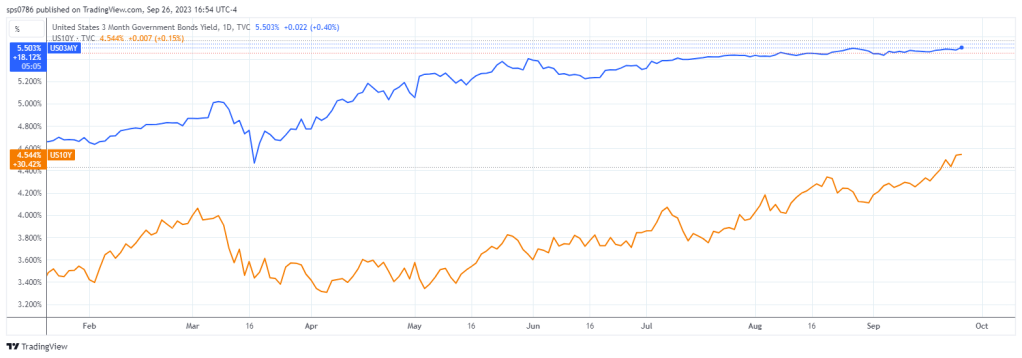

Somehow, someway the US economy is avoiding recession and defying all economic indicators that were once deemed reliable while suffering from some of the deepest yield curve inversions ever seen.

Despite the inversion of the 3 month and 10 year, the consumer keeps spending and keeping the economy afloat. Good thing the US consumer doesn’t give a shit about an inverted yield curve.

Markets are having a hard time figuring out where rates are headed and I think the Fed is too. The Fed is trying to achieve a soft landing and tame inflation. A damn near impossible task, but they may do it.

Only time will tell…

Leave a comment